L'immobilier est-il toujours un investissement valable?

Un modèle notable que j'ai souvent observé au sein de notre marché immobilier est la vigilance constante d'un groupe choisi d'individus et d'investisseurs, tous prêts pour de nouvelles opportunités d'acquisition. Cependant, certains clients potentiels, suivant les indices d'investisseurs renommés tels que Warren Buffett et les conseils de leurs banquiers ou comptables, ont des réserves quant à s'engager davantage dans le secteur immobilier. En fait, Warren Buffett a même qualifié l'immobilier d'investissement médiocre.

Néanmoins, lorsque nous prenons du recul pour examiner la situation dans son ensemble, le récit change radicalement. En 1963, le prix moyen d'une maison au Canada était de 15 229 $. (Source: Sans titre (publications.gc.ca).

Les taux d'inflation du Canada ont fluctué au fil des années, avec un taux d'inflation annuel moyen de 3,87% et un taux médian de 2,71%

Source: Taux d'inflation au Canada (worlddata.info)

Combien devrait valoir aujourd'hui au Canada une maison achetée dans les années 1960?

Une question pertinente se pose pour les investisseurs immobiliers : Si une maison a été achetée au prix moyen canadien en 1963, quelle serait sa valeur en 2022 ? Les calculs, basés sur les taux d'inflation mentionnés précédemment de 1963 à 2022, conduisent à une réponse surprenante. Le prix moyen projeté d'une maison pour 2022 s'élève à 135 968 $, un contraste frappant avec le prix moyen réel actuel d'une maison au Canada de 664 936 $ (source : CREA | National Price Map ).

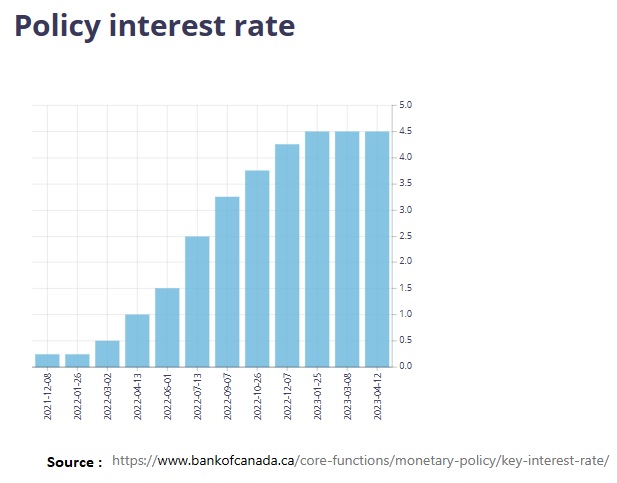

Alors, que pouvons-nous déduire de cette disparité significative ? Pourquoi le prix moyen d'une maison a-t-il augmenté 44 fois au Canada depuis 1963, alors que les données sur l'inflation suggèrent qu'il aurait dû augmenter d'environ 9 fois ? Les explications font souvent appel à des théories de l'offre et de la demande, à la baisse des taux d'intérêt, à l'urbanisation, à l'investissement étranger et à la croissance économique. Cependant, ces interprétations ne rendent pas entièrement compte de la réalité observée. La clé pour comprendre cette divergence réside dans l'analyse de notre masse monétaire

L'analyse et l'explication de la masse monétaire

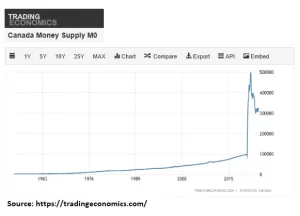

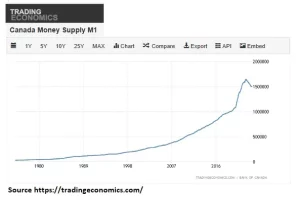

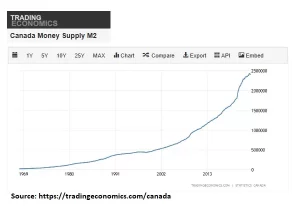

La masse monétaire – qui comprend la nouvelle monnaie introduite dans l'économie – a connu une augmentation spectaculaire, comme l'indiquent les graphiques M0, M1 et M2 (voir ci-dessous). En d'autres termes, notre monnaie a été dévaluée ou diluée en raison de l'afflux de nouvel argent dans le système.

Offre de monnaie Le "M0"

Offre de monnaie M2

Conclusion

Revenant à la question initiale : Investir dans l'immobilier en vaut-il la peine ? La réponse dépend de la volonté de l'investisseur de suivre cette dévaluation économique de la monnaie. Si tel est le cas, l'investissement immobilier devient une protection efficace. Non seulement il représente un moyen de constituer une richesse au fil du temps pour sa famille et les générations futures, mais il sert également de mécanisme de défense puissant contre la dévaluation de la monnaie.