Apartment buildings: Fighting rising interest rates

Interest rates are the lifeline of our real estate world. Without the lenders and financial leverage, all investors would have to buy any investment properties in cash, completely removing the whole concept of leverage, ROI and yields from our business.

Real estate ownership is generally a long-term play, however, and an owner will see rates go up and down during the duration of asset holding. Managing the financial aspect of leverage (debt) can make the difference between winning and losing the game of returns.

Currently, the central banks have made the unfortunate decision of fighting inflation by penalizing the debtors and hence we have seen a massive push of rate hikes since last year.

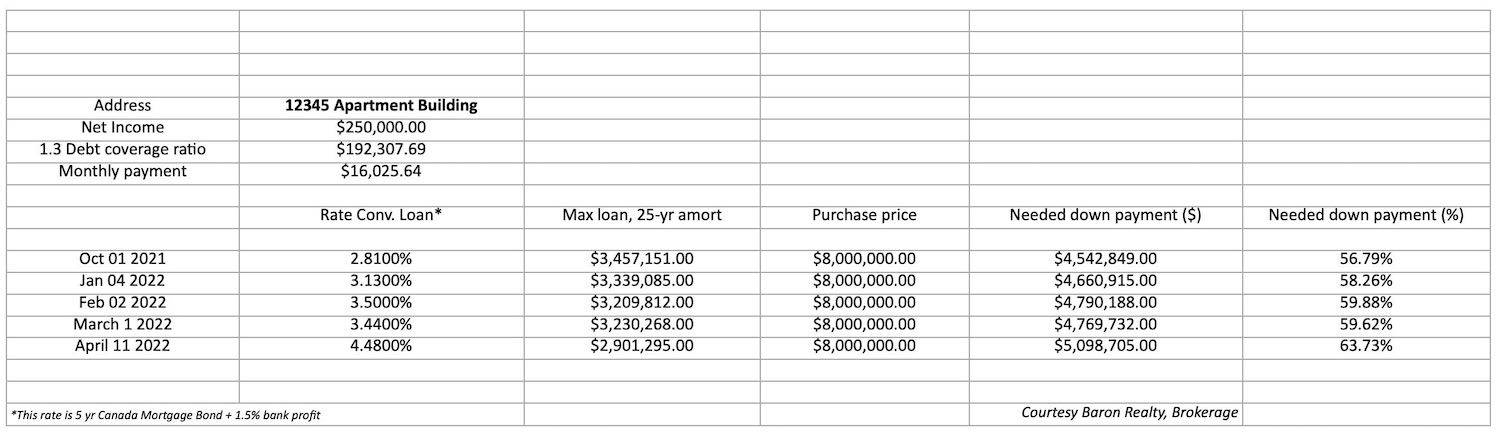

A five-year insured mortgage would have had an interest rate of 1.80 per cent in June 2020, 2.30 per cent in June 2021 and 4.60 per cent as of June 2022.

Not only will these rate hikes cause problems to the cash flow of the borrower, but they will also significantly impact the financing obtained, as the loan amount obtained will be lowered by 33 per cent, which has to be made up by either lowering the sale price or providing a higher down payment.

The solution

How should multiresidential owners combat this rate hike?

The only property owners who will be able to navigate properly in this kind of environment will be those able to increase their net operating income to make up the difference (net operating income is the income left after all the fixed costs like property taxes, insurance, utilities are removed from the gross revenues), since one of the most important criteria that the lenders use when evaluating a property is its net operating income in place.

These solutions that follow will seem very basic to the experienced landlords, yet in our brokerage business most properties that we sell are hardly optimized.

There are three main ways to increase the net income:

Renovations of units

Beautifully renovating one unit and increasing its monthly rent by $200 per month seems trivial, yet this means an increase in the property valuation by approximately $50,000. Repeating this process four times gives $200,000 of increased asset valuation.

Property insurance

Each dollar saved monthly on the insurance bill will potentially increase the property value by $240. This by itself is a 1,900 per cent return on investment annually, and it does not cost anything more than shopping around for the right insurer or the right insurance broker, because there are major discrepancies between insurers in terms of rates.

Energy costs

Energy is an entire other problem we are seeing these days.

The high prices paid by all of us at the pumps are a real problem, but a bigger problem is natural gas prices year-over-year. The average natural gas bill has gone up approximately 25 per cent in 2022 versus 2021.

If the natural gas bill in 2021 for a given property was $20,000, that same property is now going to pay $25,000.

This $5,000 increase in the gas bill means a $100,000 decrease in asset valuation. This issue cannot be left uncorrected.

The owner must know all the energy programs available to perhaps change the in-place heating furnaces to more efficient ones, or learn about the various CMHC energy programs, which are always updated and changed and may provide high benefits to the landlords based on specific situations.

In conclusion

We have seen a significant change in the capitalization rates between 2021 and 2022. However, the capitalization rate is not the only measuring factor in property valuation. The net income of the property remains the most important element.

By doing the needed renovations to the units when they become vacant, by managing the property expenses including insurance and energy maintenance, the prudent property owner will come out much ahead versus those that are not pro-active in our current higher interest rate environment.

More details in an interview with STOREYS: Interview Link

Immobilier Baron se spécialise dans la mise en relation d'acheteurs et de vendeurs d'immeubles d'appartements. Ramona travaille en partenariat avec Mikael Kurkdjian et une équipe de professionnels de l'immobilier pour offrir les meilleurs services de courtage de type boutique dans le domaine des transactions d'appartements en Ontario et au Québec.