The Bank of Canada is going back to normal, what does that mean for multifamily real estate owners?

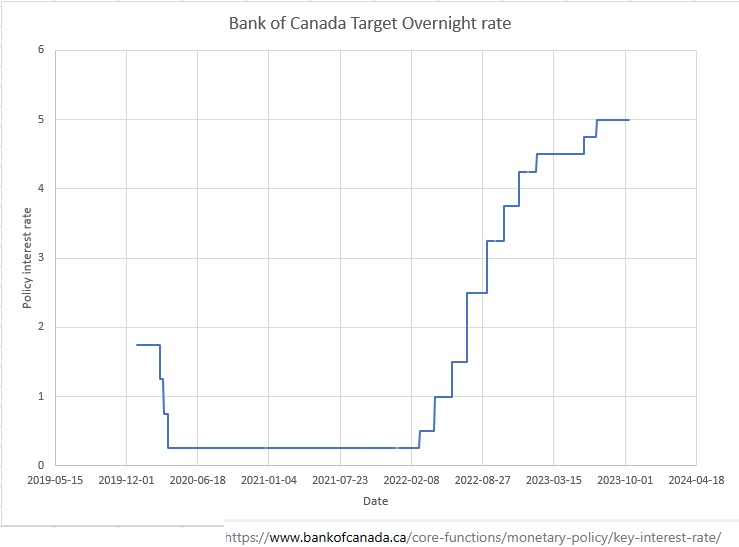

In the press release dated March 21, 2024, the Bank of Canada heralded a return to “normalcy,” indicating they are nearing the completion of their balance sheet normalization efforts.

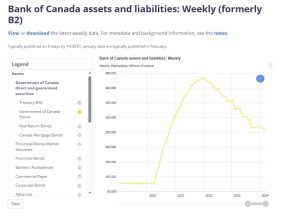

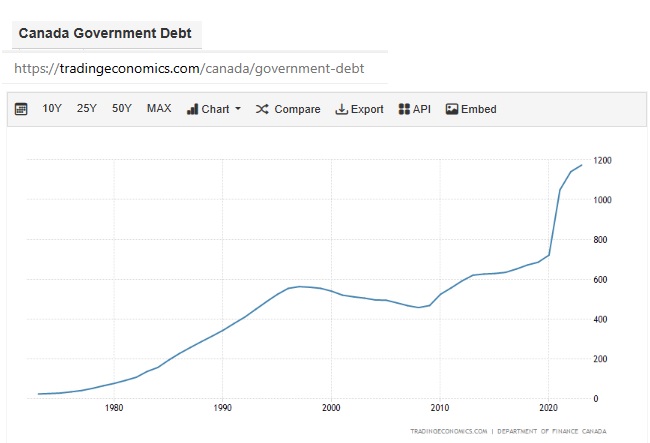

Since April 2022, there’s been a concerted effort to reduce their balance sheet size. Delving into the Bank of Canada’s holdings of Government of Canada Savings Bonds, a stark reduction is evident. From a peak in December 2021 of nearly $435 billion, holdings dropped to about $260 billion by early March 2024.

What implications does this have for interest rates, and why does it matter?

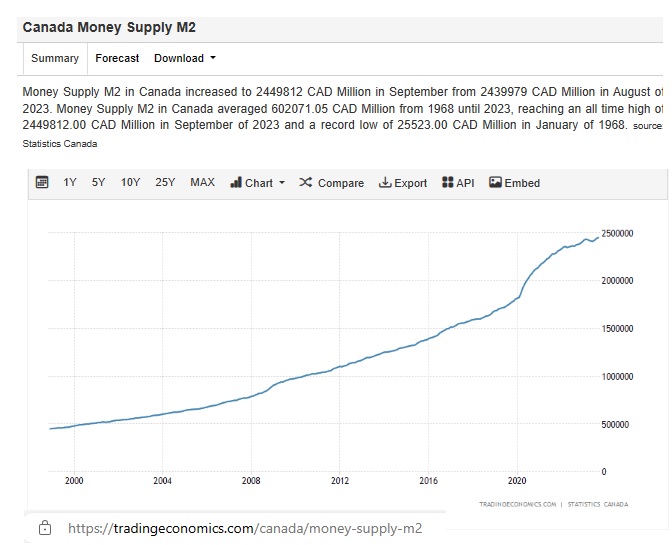

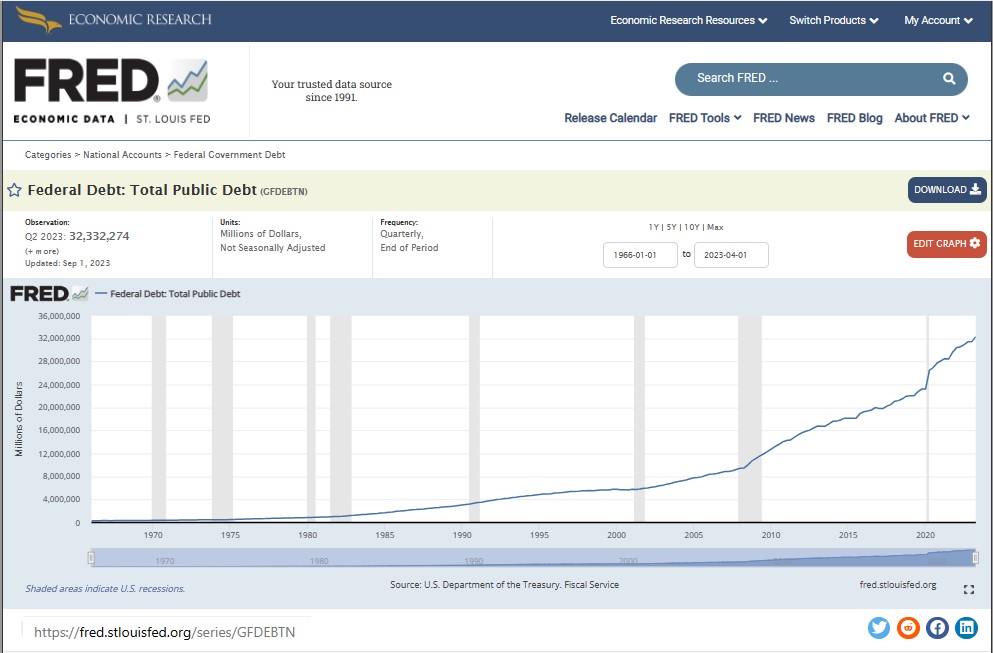

To some, this might seem negligible against the backdrop of Canada’s total outstanding mortgage debt market, valued at approximately $1.8 trillion.

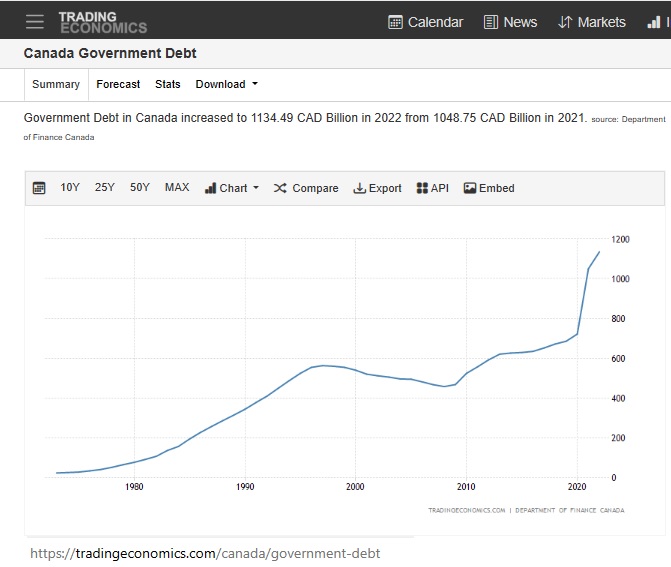

Yet, this shift is profoundly significant. The 40% decrease in savings bonds holdings by the Bank of Canada necessitated the sale of an additional $175 billion in savings bonds to entities other than the Bank of Canada.

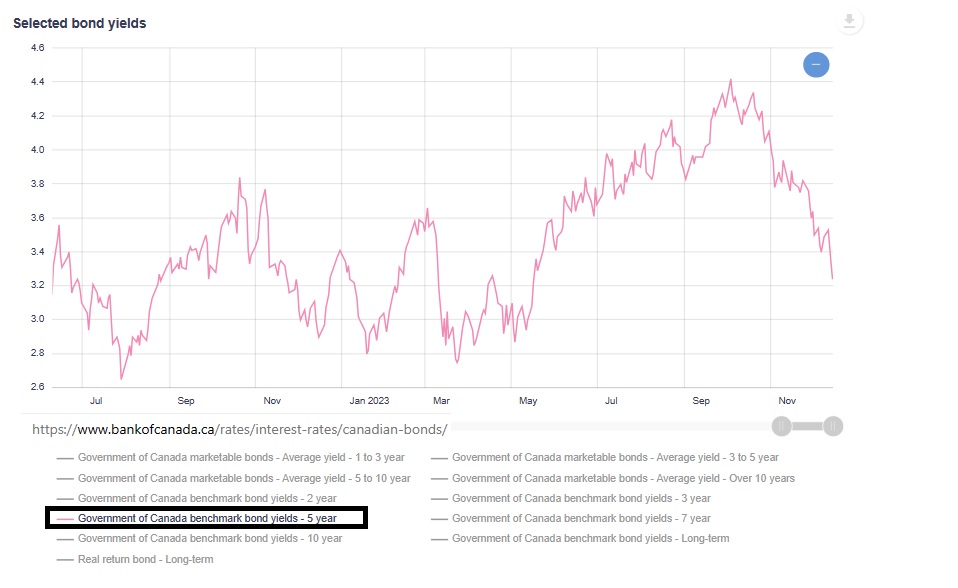

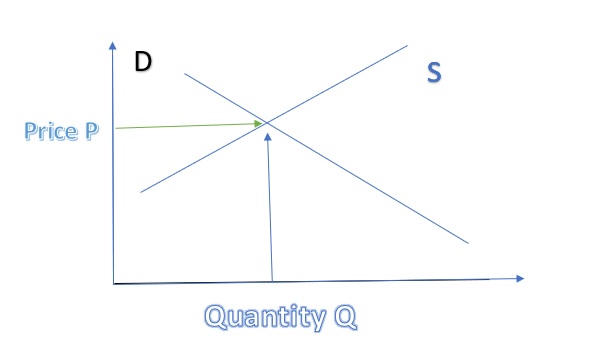

This new cohort of buyers—private, retail, or institutional—demanded attractive yields, thus keeping interest rates elevated.

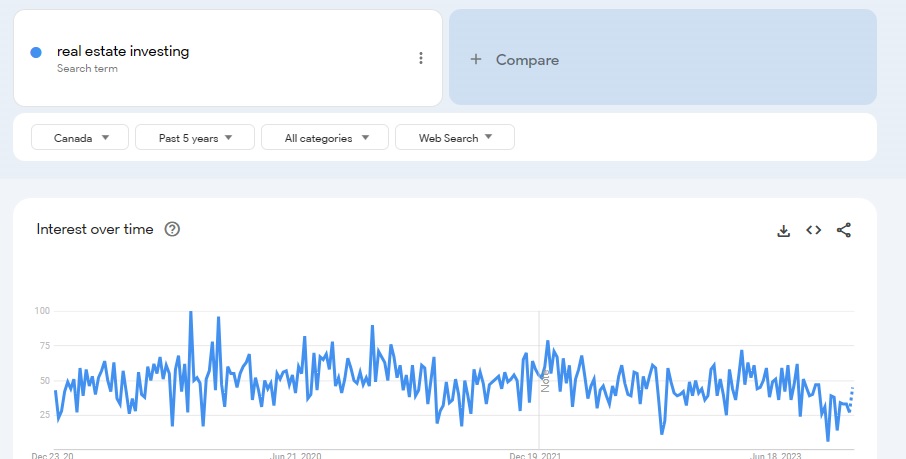

In discussions with property owners and investors in the multifamily brokerage realm, many anticipate a decline in interest rates later in the year.

This expectation leads sellers to postpone selling their properties, foreseeing higher values as interest rates drop, cap rates decrease This action of course makes available properties for purchase diminish, complicating acquisitions.

However, from our perspective at Baron Realty as of March 26, 2024, even a potential rate decrease is unlikely to be substantial.

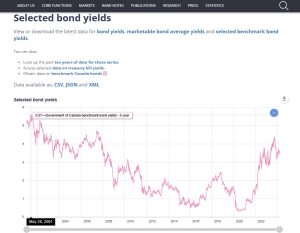

Reviewing the 5-year Government of Canada Savings Bond rates since 2001, today’s 3.44% rate—though high compared to the 0.35% rate of 2020, an atypical year due to the COVID-19 pandemic—remains

lower than the early 2000s rates, which hovered around 5.57%.

For property owners and real estate investors, the focus should be on controlling revenue and expenses.

Enhancing revenue by upgrading units to align with market rents and minimizing expenses will inherently boost property value.

Relying on Central Bank policies or bond market fluctuations to lower rates isn’t a proactive strategy. Improving a property’s net operating income naturally enhances its value, irrespective of interest rate movements.