Why Invest in real estate?

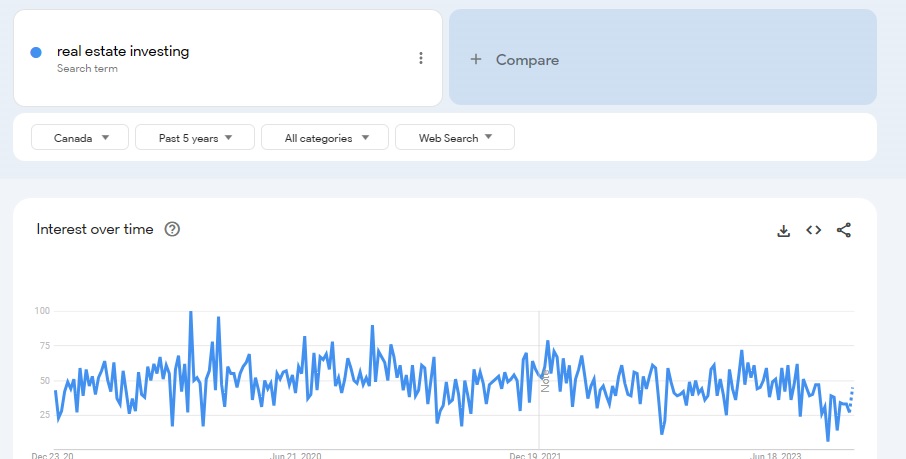

Investing in real estate in Canada is a topic that ebbs and flows in popularity, much like other subjects of interest. A look at Google Trends over the past five years reflects this cyclical nature.

But beyond trending topics, those who have consistently invested in real estate over the long term have built significant wealth, regardless of economic fluctuations.

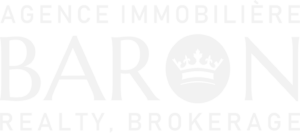

In recent months, for instance, we’ve witnessed the interest rate of the 5-year Canada Mortgage Bond drop from 4.12% in early September to 3.54% on December 14, 2023.

This decline sparked optimism among many property owners and investors, hoping that this trend might continue into 2024 and 2025. If so, it could make financing new property purchases or sales more accessible due to lower interest rates.

This perspective isn’t without merit. In theory, lower interest rates should pique the interest of real estate investors. However, real estate investment should be a continuous endeavor, irrespective of fluctuating interest rates.

So, why should one consider investing in real estate in Canada?

There are always sellers that need to or want to sell for different reasons (old age, partnership dissolution, they need to move, retirement, tired of investing in real estate for various reasons, etc.) , but why would multifamily real estate investors want to invest in Canada?

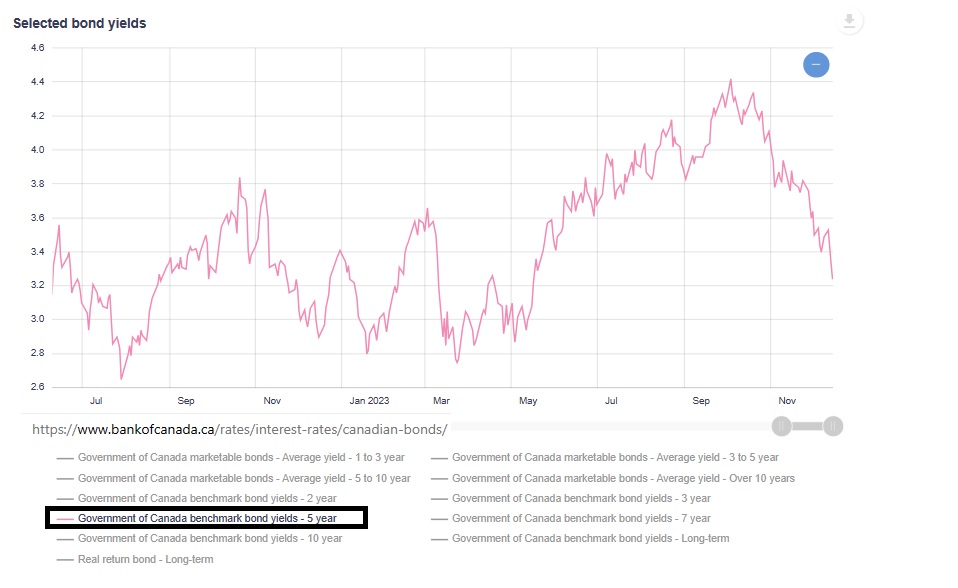

1 – Stable Market with Growing Population: The Canadian real estate market is robust and stable. There’s a consistent demand for multifamily properties, especially as Canada’s population, which has nearly tripled since 1950, continues to grow. This trend is projected to remain positive over the next 30-50 years according to UN projections, indicating an ongoing need for housing.

2 – Tax Benefits: Investing in rental properties in Canada comes with significant tax advantages. The current tax code allows deductions for the interest portion of mortgage payments, operating expenses, and renovation costs. These incentives make real estate an attractive investment option.

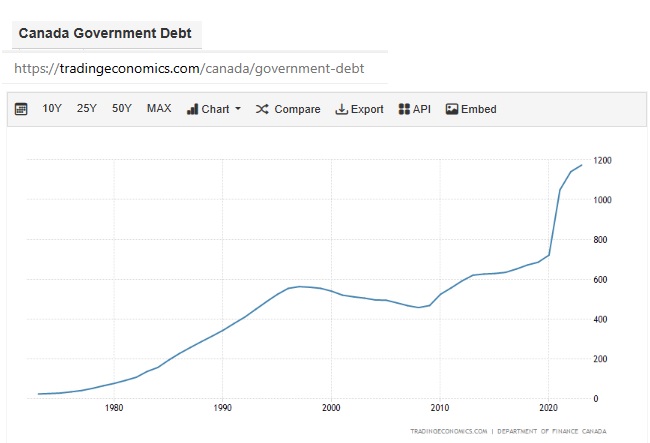

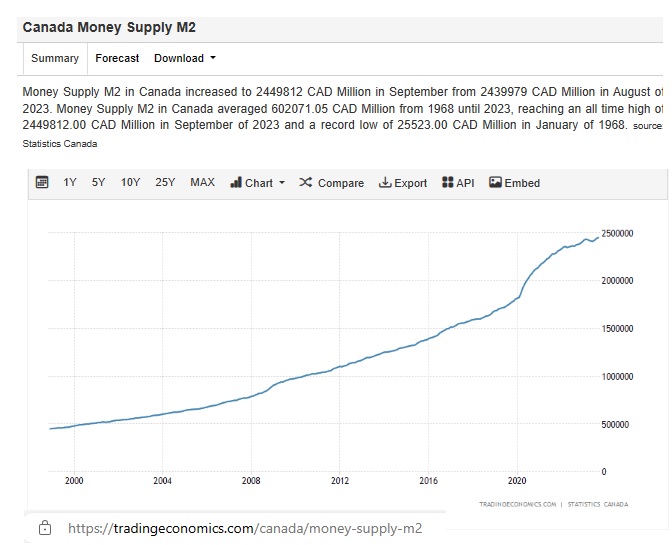

3 – Hedge Against Inflation and Currency Debasement: With the Canadian Federal deficit at approximately 1.2 trillion dollars

and a growing money supply (a 5X increase since 2000), the value of real assets like real estate tends to rise. This inflationary trend means that real estate can serve as an effective hedge against the diminishing purchasing power of currency.

4 – Investment real estate ownership as a business: An apartment building is, in essence, a standalone enterprise. If you own multiple buildings, you’re essentially managing multiple businesses. The key to success in this venture is tenant satisfaction. Investing in your properties, enhancing living conditions, and improving rental income not only benefits the tenants but also increases the value of your investment. Therefore, astute real estate investors who prioritize their tenants can create significant value in their portfolio.

In conclusion, real estate investment in Canada offers a unique blend of stability, tax benefits, protection against inflation, and the opportunity to grow a business. It’s an investment avenue worth considering for anyone interested in building long-term wealth.