A notable pattern I’ve frequently observed within our real estate market is the constant vigilance of a select group of individuals and investors, all poised for new acquisition opportunities. However, some prospective clients, taking cues from renowned investors such as Warren Buffett and the advice of their bankers or accountants, harbour reservations about further committing to the real estate sector. In fact, Warren Buffett has even called real estate a lousy investment.

Link : Warren Buffett Says Real Estate Is a Lousy Investment: Why He’s Wrong | The Motley Fool

Nevertheless, when we step back to examine the bigger picture, the narrative shifts dramatically. In 1963, the average house price in Canada was $15,229 (source: untitled (publications.gc.ca).

Canada’s inflation rates have fluctuated in the years since, with the average annual inflation rate being 3.87%, and the median rate, 2.71%.

Source: Inflation rates in Canada (worlddata.info)

What should a home bought in the 1960s be worth today in Canada?

A pertinent question for real estate investors arises: If a house was bought at the average Canadian price in 1963, what would its value be in 2022? The calculations, based on the aforementioned inflation rates from 1963 to 2022, lead to a surprising answer. The projected average house price for 2022 stands at $135,968, a stark contrast to the current real average home price in Canada of $664,936 (source: CREA | National Price Map ).

So, what can we infer from this significant disparity? Why has the average home price increased 44-fold in Canada since 1963, while the inflation data suggests it should have risen by around 9 times? Explanations often involve theories of supply and demand, declining interest rates, urbanization, foreign investment, and economic growth. However, these interpretations don’t entirely account for the observed reality. The key to understanding this discrepancy lies in analyzing our money supply.

The money supply analysis and explanation

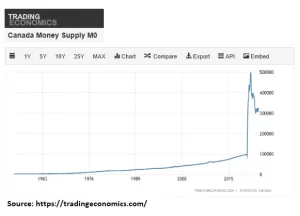

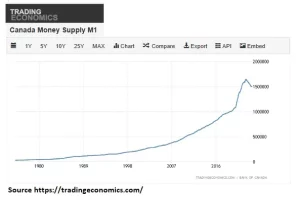

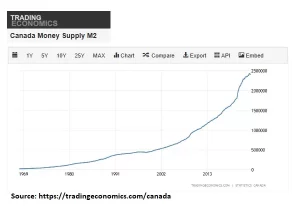

The money supply – which comprises the new currency introduced into the economy – has experienced a dramatic surge, as indicated by the M0, M1, and M2 charts (see below). In other words, our currency has been debased, or diluted, due to the influx of new money into the system.

M0 Money Supply

M2 Money Supply

Conclusion

Returning to the initial question: Is investing in real estate worthwhile? The answer depends on whether the investor wishes to keep pace with this economic currency debasement. If so, real estate investing becomes an effective safeguard. Not only does it present a means to build wealth over time for one’s family and future generations, but it also serves as a potent defense mechanism against currency debasement.