This week, I came across a fascinating article on a significant shift in investment trends.

The article discussed the results of a survey which showed a decline in the popularity of real estate investing among 1,013 U.S. adults, falling from 45% in 2022 to 34% in 2023. It’s worth noting that similar figures are likely to be seen in Canada.

Real estate has historically held appeal for many investors, but its popularity can and will plummet when aligned with a cycle of rising interest rates.

Unpacking the Underlying Issue

Post-Covid-19 events that unfolded globally (including government stimulus packages, global lockdowns, and supply chain issues) triggered intense inflationary pressures. Central Banks, like the US Federal Reserve, responded with rapid short-term interest rate hikes to curb inflation.

For instance, the US FED Funds rate saw ten consecutive increases from March 2022, skyrocketing from 0.25% to 5.25% – a 2,000% increase over 14 months.

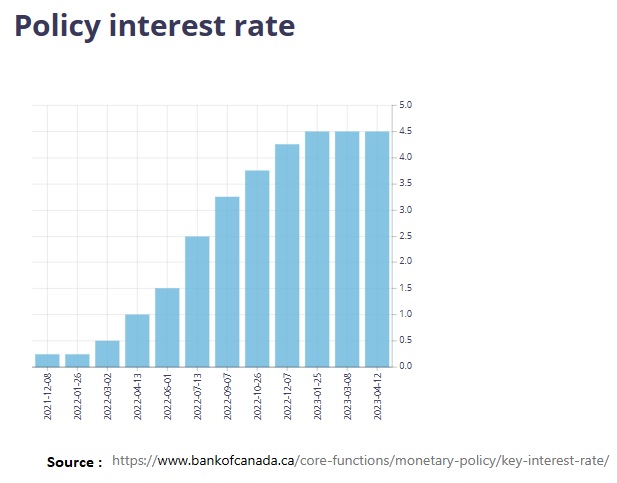

Given the size of the US economy, which represents 24% of the global economy (note 1), other central banks had to follow suit. The Bank of Canada, fearing capital flight and potential currency devaluation, mirrored the US FED’s strategy, pushing its policy rate from 0.25% to 4.25% – a staggering 1,700% increase in the same period.

These unprecedented short-term interest rate hikes significantly impacted bond markets and, by extension, mortgage interest rates for borrowers, affecting the viability of real estate investing significantly.

Consider an investor owning a building with a net operating income of $100,000. In February 2022, the property could support a refinance mortgage of $1,646,450. (Amortization 35 years, mortgage rate of 3.10%). Now, due to these changes, the property can only sustain a mortgage of $1,334,280 (mortgage rate increased to 4.66%) — a nearly 20% drop. This drastic decrease in refinancing capabilities significantly dampens the enthusiasm of real estate investors, explaining the dwindling popularity of this investment avenue, particularly in robust asset classes like multifamily properties, the situation is compounded. Sellers in these sectors are typically disinclined to part with their assets unless they are offered a satisfactory selling price.

Unearthing Additional Issues

Undeniably, there are other factors at play contributing to the current real estate climate. Certain real estate sectors, like office properties, have experienced a surge in vacancy rates over the past few years. The rise of remote work culture among many companies has dramatically altered the landscape of office demand, subsequently affecting investors’ borrowing power. Similarly, the retail real estate sector has long been grappling with its own challenges.

The escalating competition from online shopping, amplified by the impact of the recent Covid-19 lockdowns, has forced many smaller retail stores to shutter or drastically cut down their sales volume.

The Path Forward

Despite these hurdles, the solution for real estate investors remains straightforward. Real estate continues to be a powerful tool for wealth creation and inflation hedge.

Its unique appeal: banks can lend against it, providing investors with the leverage needed to grow their portfolios.

In our inflationary environment that has started climbng since 2021, it’s more important than ever for property owners to enhance their property’s financial health. Property owners must treat each property as an individual business entity. Just as public companies strive to generate returns for their shareholders, so should real estate owners view their properties. By providing superior services and amenities to tenants, property owners can improve their property’s financials. Each incremental increase in net operating income directly elevates the property’s value.

Thus, regardless of interest rates or wider economic conditions, a proactive property owner can still thrive.

Note 1 source: https://www.visualcapitalist.com/u-s-share-of-global-economy-over-time/

Mikael Kurkdjian, the broker of record (AEO in Quebec) with Baron Realty and licensed real estate broker in the Quebec and Ontario markets in Canada. Mikael is also a multifamily real estate investor himself.