A slowdown in transactions, ‘real’ sellers and the new normal

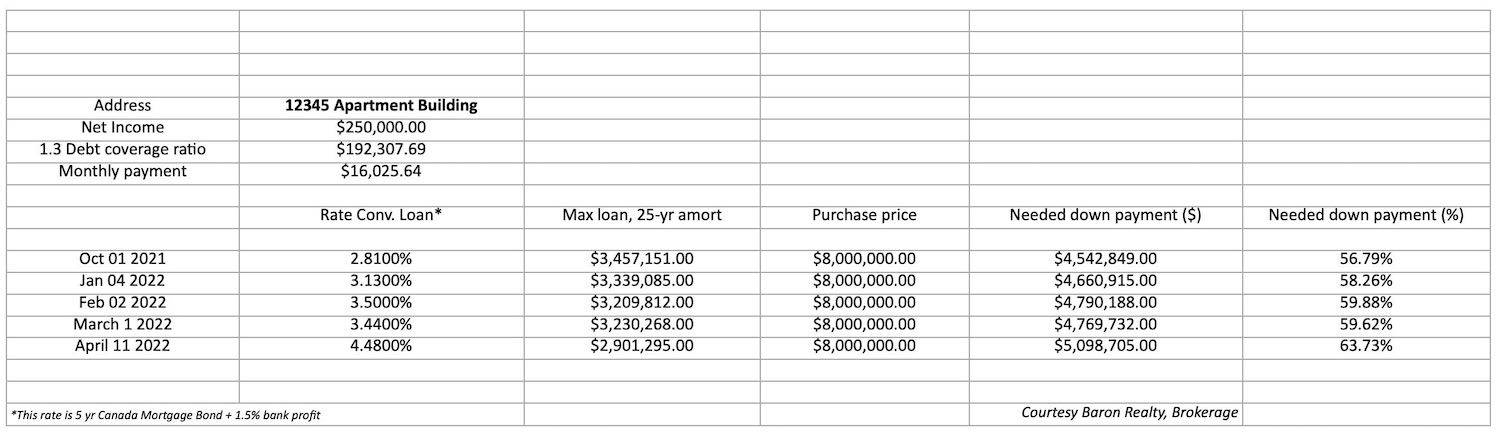

The loan available against a property is highly affected by interest rates: the higher the rate, the lower the loan available and hence, the more down payment a buyer needs to complete a purchase.

With interest rates rising significantly and virtually overnight at the beginning of the year, we saw two significant and immediate changes in the transactions market.

Market conditions have changed rapidly

The first one has to do with the fact that any apartment building transaction requires preparation.

One must review and analyze the vendor materials; prepare the marketing; and sometimes in parallel, complete the environmental assessment (a two- to three-month delay) without which banks would not lend against the property.

These coupled due diligence items mean that for the vendor who decided to list the property in late 2021, when the interest rates were at their lowest, the spike hit during the listing and marketing process.

This caused some deals to fall through and buyers to backpedal on conditional commitments, and/or reconsider the value of the asset.

Hence, many of the properties listed for sale never traded and/or are currently still sitting on the market at reduced prices (for some, there have been multiple price reductions).

Who are the “real” sellers?

The second change in the market is the immediate identification of “real” sellers versus owners who would have otherwise sold, but do not have to.

“Real” sellers are owners who want or need the asset sold at a certain moment in time (within the calendar year). This could be due to a variety of situations:

– dissolutions of partnerships;

– lack of interest or ability to continue managing the asset;

– changing family dynamics (many rental assets are owned and managed under private family ownerships); or

– financial inability to keep up with rising mortgage payments (for the loans that came due during interest rate spike) and building maintenance costs.

The transactions we see getting done into 2022 involve sellers who understand that neither the seller nor the broker determine the price – it is determined by the market.

The market is always affected by much bigger dynamics than the buyers’ interest in owning investment properties.

The foreseeable future

We believe the current market is here to stay, with the interest rates at the same level now as they were in 2008.

The U.S. Federal Reserve has clearly indicated it plans to continue to fight inflation by keeping the interest rates at these levels or higher. Other central banks need to follow the U.S. in keeping their rates at similar levels in order to avoid currency devaluations.

What this means is the record low “pandemic-level” interest rates we had in recent years are a thing of the past and we are now in the “new normal.”

Both sellers and buyers should get used to these interest rates and focus on increasing the property values by providing more services to the tenants, increasing rents and decreasing the expenses in place.

We remain available to advise on these strategies.

Baron Realty custom-tailors each marketing process, and brings the right buyers based on the asset and vendor requirements for deal timelines. We have generated 5-12 offers on each of the listings we have taken over the last 18 months. *Ask us why; we are happy to talk to you about how to best navigate the current environment to achieve your end goal.

Baron Realty specializes in matching buyers and sellers of apartment buildings. Ramona works in partnership with Mikael Kurkdjian and a team of real estate professionals to bring the best boutique-brokerage services to the apartment transactional space in Ontario and Quebec.